How to Calculate the Breakeven Point for a Small Business

At what point does your business go from losing money to making money?

In every business, there is a point in which you go from losing money to making money. This is called your breakeven point. It is the volume of sales at which you have covered all your costs but have nothing left for profit. Once you understand where that point is you can start making decisions that have a direct impact on your bottom line.

The best place to start is a primer on costs and how they behave. Some costs are fixed. They stay the same all the time. Examples of fixed costs are rent, insurance, and car payments. Other costs are variable. Variable costs go up as you sell more services or products. Great examples of variable costs are ingredients (in a food service business), raw materials (in a manufacturing business), and labor (in a service-oriented business). The idea of variable costs is that if your pricing is consistent, your variable costs will always be the same or very close to the same percentage of your sales. As your sales go up, your variable costs go up by the same percentage. The last group is a mix of the two. Mixed costs increase as sales increase but not always by the same percentage. Examples of this might be fuel for company vehicles, employee benefits (they are fixed until sales go up to the point where you need to hire more staff), utilities.

If you can get a clear understanding of your company’s costs, you can mathematically determine your breakeven point. The mixed costs are always the sticky part because it can be tough to determine their exact percentage of sales. Because of this, analysts lump mixed costs and variable costs together when attempting to calculate a simple breakeven point. The algebraic formula looks like this:

R = Revenue

V = Variable Cost Percentage of Revenue

F = Fixed Costs (actual dollar amount)

R – (R x V) – F = 0

What?

I get it. Algebra is not for everyone, but fortunately, Excel can tackle this in seconds.

Open a blank sheet in Excel and build a simple little grid that looks like this:

Here is a little more explanation on what goes in each row:

Note 1:

Your time period for fixed costs needs to be the same as your time period for revenue. It could be weekly, monthly, or annually. It just needs to be the same.

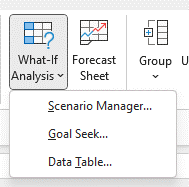

Once you have the little grid laid out in Excel, you can use the “Goal Seek” feature to figure out what your breakeven point is. If you are using the latest version of Excel, you can find Goal Seek under Data and then What-If Analysis.

Open up Goal Seek and answer the questions this way:

Set Cell: B4

To Value: 0

By changing cell: B1

Then click “Okay”

It will return the result – in the example above, the resulting revenue number should be $35.71. This is the revenue point at which your profit is zero. You have covered all your costs.

Once you reach your breakeven point in revenue, you can comfortably assume that percentage of your revenue that is the inverse of your Variable Cost Percentage of Revenue (if the variable percent is 30%, the inverse is 70%) will fall directly to your bottom line as profit. This is because your fixed costs for this period have all been paid for at the breakeven point.

Why is this Important?

This exercise is important for several reasons – the least of which is that you need to know how much revenue you need to keep your doors open. The real benefit, however, is knowing at which revenue amount you can start deciding what you want to do with your profits. If you can reasonably estimate your profits based on various intervals of revenue, you can plan new projects, determine when you can hire new staff or expand a service or product line, or determine how much you can donate or give away in a given period.

| Thank you for Signing Up |